child tax credit september 2021 deposit date

Those who choose direct deposit can expect to get payments in up to 10 days while it could take as much as a month for paper checks. This rule prevents adults from buying a home with cash in the name of a child then claiming the tax credit on the childs.

Child Tax Credit 2021 How To Track September Next Payment Marca

You are not claimed as a dependent on any other persons federal income tax return.

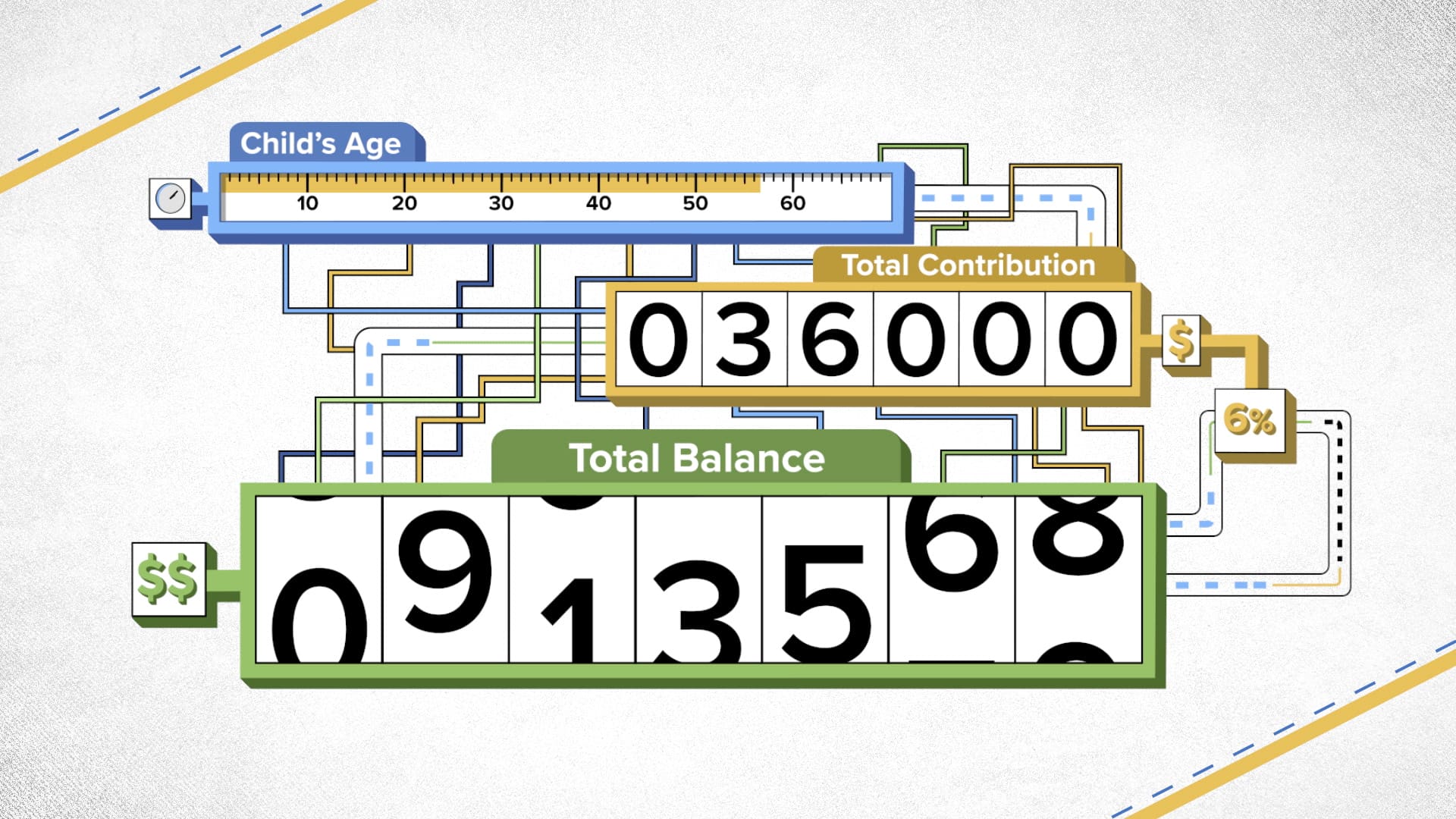

. Jennifer Korn 30th Jun 2022. The advance child tax credit payments were early payments of up to 50 of the estimated child tax credit that taxpayers may properly claim on their 2021 returns. Line 29 American opportunity credit from Form 8863 line 8.

September 30 2021 and December 31 2021. Income limits and other criteria may also be found in the PTC rebate application booklet for the application year. Governor Ned Lamont signed the 2022-2023 budget bill in June which included a child tax rebate.

Is 18 years of age. Senior research associate at the Urban Institute and the Tax Policy Center Elaine Maag stated the total take-rate for the earned income credit might be quite high around 86 according to research. Josh_Moon September 27 2021.

Simple or complex always free. Additionally households in Connecticut can claim up to 750 under a child tax credit program as long as they apply by July 31. Find Your W-2 Online.

A charge for processing all creditdebit card transactions for property tax payments. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Try the Free tax calculator to see how big of a refund you can get when you claim the Child Tax Credit.

There is no end date specified and the 15000 tax credit could become permanent. Advance child tax credit payments. Line 31 Amount from Schedule 3 line 13.

Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. The First-Time Homebuyer Act or 15000 First-Time Homebuyer Tax Credit of 2021 is not a loan to be. Alabama reporter Josh Moon shared on Twitter in September that the expanded child tax credit helped lift thousands of kids out of poverty.

Tax Season 2021 2022 Start Date. We dont make judgments or prescribe specific policies. Last day to open auction trust account or deposit funds Tuesday May 17 2022 at 100 PM.

See what makes us different. 1040 Form. The current tax season has been as bumpy as the last with many tax filers reporting delayed refund payments due to IRS processing backlogs and reconciliation of catch-up payments for stimulus checks RRC and advance child tax credit payments.

These are your total other payments and refundable credits. Line 27 Earned income credit EIC Line 28 Additional child tax credit. You were at least 65 years old by December 31 2021 or are a surviving spouse at least 58 years old by December 31 2021.

On the other hand this tax season the Earned Income Credit is worth as much as 6660 for families with 3 or more eligible children. From July through December 2021 advance payments were sent automatically to taxpayers with qualifying children who met certain criteria. Line 32 Add lines 27 through 31.

The deadline for applications was July 22 and now city officials expect payments to be sent out in August or September. The estimated 2021-2022 IRS refund processing schedule below has been updated to reflect the official start. If the bill passes.

File a federal return to claim your child tax credit. Line 30 Recovery rebate credit.

Time Is Running Out To Sign Up For Advance Child Tax Credit Checks

Childctc The Child Tax Credit The White House

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

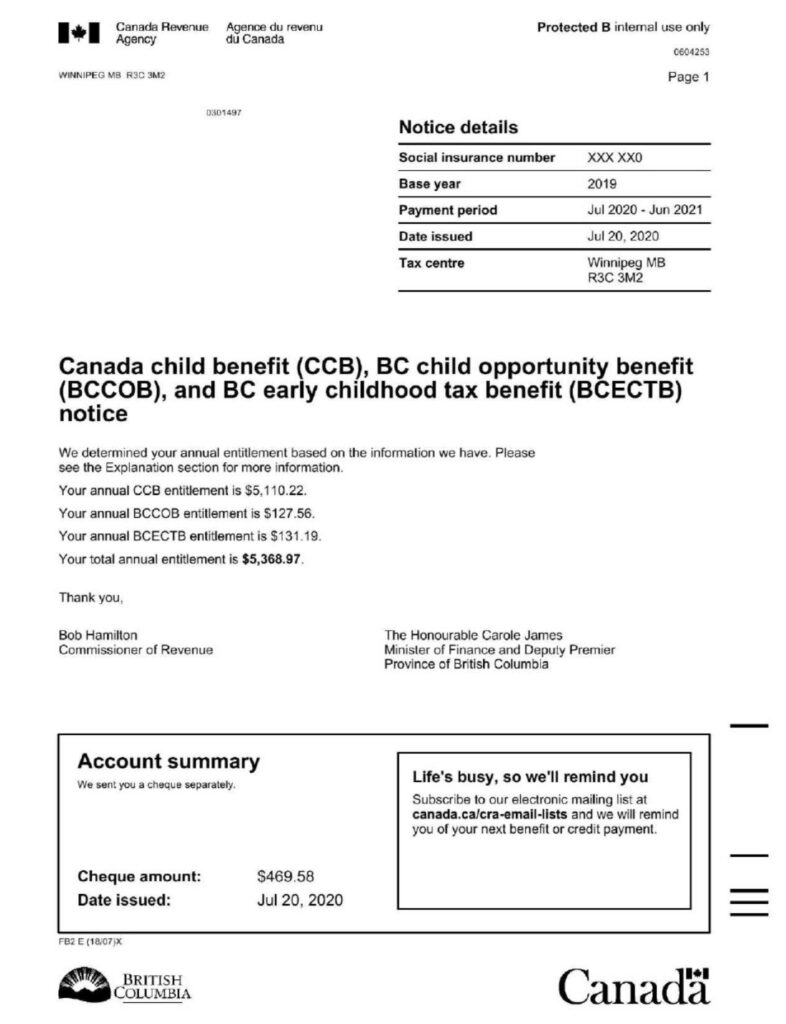

Gst Payment Dates 2022 Gst Hst Credit Guide Filing Taxes

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Online Canada Revenue Agency Cra Direct Deposit Enrollment

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

What To Know About September Child Tax Credit Payments Forbes Advisor

Where S My Child Tax Credit Payment A Guide For Frustrated Parents The Washington Post

What To Do If You Still Haven T Received Your Child Tax Credit Payment Forbes Advisor

What Is Canada S Fed Deposit In 2022 Filing Taxes

Child Tax Credit Dates 2021 Latest August 30 Deadline To Opt Out Of September Payments As Parents Flock To Irs Portal The Us Sun

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Irs Releases Child Tax Credit Payment Dates Here S When Families Can Expect Relief

Child Tax Credit Schedule 8812 H R Block

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Ach Deposit Authorization Form Template Inspirational 10 Securitas Direct Deposit Form Electronic Forms Deposit Directions

Canada Child Benefit Ccb Mackenzie Gartside Associates

Child Tax Credit 2021 8 Things You Need To Know District Capital